Contents:

Based on its current ratio, it has $3 of current assets for every dollar of current liabilities. Its quick ratio points to adequate liquidity even after excluding inventories, with $2 in assets that can be converted rapidly to cash for every dollar of current liabilities. The current ratio measures a company’s ability to pay off its current liabilities with its current assets such as cash, accounts receivable, and inventories. Solvency and liquidity ratios are similar, but there are some key differences. The main distinction is that solvency ratios provide a longer-term perspective on a company, whereas liquidity ratios focus on the short term. The cash flow statement also provides a good indication of solvency, as it focuses on the business’ ability to meet its short-term obligations and demands.

Alpha and Beta are two companies operating in the same line of business of Leather Shoe Manufacturing, which has furnished certain details from their Balance Sheet at the end of the year. Conversely, it can be calculated by taking the inverse of the Financial Leverage Ratio. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency .

COMPARATIVE INCOME STATEMENT: Types, Format, and Examples

An improving liquidity position may help the company in getting its finances in order. The other ratios analysing a company’s finances include interest coverage ratio indicating the debt servicing capability of a company. Also, solvency ratios or financial ratio vary between different types of industries. An interest coverage ratio measures a company’s ability to finance its interest payments on outstanding debt.

Moreover, you get to choose from a wide range of tenures at affordable premiums. The solvency ratio that life insurance companies declare every quarter reflects their ability to honour their promise of sum assured in case of an unfortunate event. Low current ratiomeans the chances for the company to have deficiency in liquidating its assets for payments of debts obligations is high.

Solvency Ratio FAQs

These ratios also do not account for the presence of existing lines of credit that can be drawn down to access additional funding on short notice. When there is a large and mostly untapped line of credit, a business can easily pay its bills even when its solvency ratios are showing a bleak picture of its ability to pay. To calculate the solvency ratios described in the previous section, use the formulas shown below. The company’s balance sheet has the values you need to calculate these ratios. Liquidity ratios are a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital.

The reverse situation can also arise, where a business is not especially liquid over the short term, and yet is highly solvent when viewed over a longer period of time. The main solvency ratios are the debt-to-assets ratio, the interest coverage ratio, the equity ratio, and the debt-to-equity (D/E) ratio. These measures may be compared with liquidity ratios, which consider a firm’s ability to meet short-term obligations rather than medium- to long-term ones. As you have seen, solvency ratios can help you assess a business’ long-term financial health. Debt to equity ratio – Debt to equity is known to be one of the most used debt solvency ratios. Solvency ratiois one of the various ratios used to measure the ability of a company to meet its long term debts.

Annual Report 2014 of Satin Creditcare Network Limited

In any case, even inside these cutoff points, individual solvency ratios definition insurance providers vary in their positioning. To decide the suitable life insurance provider for you, you can peruse the solvency ratios of all enrolled insurers in the annual report published on the IRDAI site. In this formula, the numerator includes the entity’s current cash flow, while the denominator is comprised of its liabilities.

Quick Ratio: Definition, Equation, Examples – Business Insider

Quick Ratio: Definition, Equation, Examples.

Posted: Fri, 08 Jul 2022 07:00:00 GMT [source]

Asset PurchaseWhen a business undertakes an asset purchase, in reality, it just taking this approach to structure the acquisition of a company. Adjusted Gross IncomeAdjusted Gross Income is the measure of an individual’s taxable income. Accrued IncomeWhen you invest, earn returns on your investments, but haven’t received the returns yet, you have an accrued income. Accrual PrincipleThe accrual principle is a very important concept in accounting, and it forms the basis of making adjusting entries during the accounting cycle, which we have covered before. Our experts suggest the best funds and you can get high returns by investing directly or through SIP.

The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets and therefore excludes inventories from its current assets. Solvency ratios examine all of a company’s assets, including long-term debts such as bonds with maturities of more than a year. In contrast, liquidity ratios examine only the most liquid assets, such as cash and marketable securities, and how they can be used to cover upcoming obligations in the short term. The ratio identifies how much of a company’s funding comes from debt versus equity contributions.

Notwithstanding, for the insurer to have the option to give this financial coverage, the insurance agency should be in a stable monetary position. Proprietary Ratio Or Equity Ratio – Proprietary ratios are otherwise called equity ratios. It constructs a connection between the owner’s assets and the net assets or capital. In general, a newly formed company, a start-up company, or a recently listed company has negative equity. As the company grows, its financial position also improves whereby it creates value for its shareholders.

- This entire set of information must then be compared to similar information for the rest of an industry, to see how well a business compares to its peers.

- Instead, these ratios must be supplemented with additional data to gain a more complete understanding of an organization’s ability to consistently pay its bills on time.

- When reviewing insurance firms, a solvency ratio is used to compare the size of the capital to the premiums written, and it measures the risk an insurer faces on claims it cannot cover.

If one of the ratios shows limited solvency, that should raise a red flag for analysts. If several of these ratios point to low solvency, that’s a major issue, especially if the broader economic climate is fairly upbeat. A company that struggles with solvency when things are good is unlikely to fare well in a stressful economic environment.

Contribution https://1investing.in/The contribution margin measures the difference between the sales price of a product and the variable costs per unit. Average Collection PeriodThe average collection period is an estimation of the average time period needed for a business to receive payment for money owed to them. Accounts Receivables TurnoverThe accounts receivables turnover is a calculation to measure how successful a company is in collecting money owed to them from customers. ACCA vs CIMAWhether you are in the accounting industry or are aspiring to become an accountant, a professional certification can improve your job prospects and earning potential. They also explain the formula behind the ratio and provide examples and analysis to help you understand them.

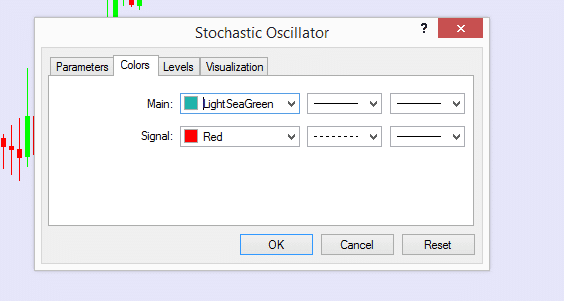

Examples of solvency ratios are noted below, where we describe the current ratio and quick ratio. The quick ratio is preferred when a business has invested in a substantial amount of inventory, since it can be difficult to liquidate inventory on short notice. When interpreting the values for solvency ratios, it’s important to consider the context. You need to get industry benchmarks, as accounting practices vary between industries, and there are different expectations regarding acceptable amounts of debt. You also need to compare with companies that are similar to yours in terms of size and scope. Solvency ratios look at all assets of a company, including long-term debts such as bonds with maturities longer than a year.

It is calculated by dividing a company’s earnings before interest and taxes by its interest expense for a given period. A high interest-coverage ratio indicates less risk of interest payment default by a company. Before an individual or organization invests or lends money to a company, they must be confident that the entity will remain solvent in the long run. Thus, interested stakeholders use solvency ratios to assess a company’s ability to repay its debts over a term. This Ratio seeks to determine the percentage of the company’s total assets (including both current and non-current assets) that are financed by debt.

The higher the calculated number is, the healthier the financial position of the company is. The lower the number is, the more the company is in debt in relation to its equity. Let’s say a company has a total debt of $25,000 and its assets amount to $18,000. Essentially, it’s used to measure the margin of safety that a company has for paying interest on its debts over a given period of time. A liquidity crisis can arise even at healthy companies if circumstances come about that make it difficult for them to meet short-term obligations such as repaying their loans and paying their employees.

Litigation Funding Comparative Guide – – United States – Mondaq

Litigation Funding Comparative Guide – – United States.

Posted: Wed, 22 Feb 2023 11:06:05 GMT [source]

Cash to Current Assets RatioCash to current assets is a liquidity ratio that measures how much of the current assets in a company are made up of cash and cash equivalents. Cash Flow Coverage RatioThe cash flow coverage ratio represents the relationship between a company’s operating cash flow and its total debt. To evaluate a given firm’s actual long-term financial stability, you need to calculate several different solvency ratios and compare them with industry averages.

Moreover, the solvency ratio quantifies the size of a company’s after tax income, not counting non-cash depreciation expenses, as contrasted to the total debt obligations of the firm. Also, it provides an assessment of the likelihood of a company to continue congregating its debt obligations. The difference between liquidity ratios is that a solvency ratio will analyze the impact on a business’s capability of being able to meet its long-term obligations. Whereas liquidity ratios take a look at the company’s ability to pay for short-term obligations. It also refers to the business’s ability to quickly sell assets in order to raise a certain amount of cash.

Another leverage measure, the debt-to-assets ratio measures the percentage of a company’s assets that have been financed with debt (short-term and long-term). A higher ratio indicates a greater degree of leverage, and consequently, financial risk. The metric is extremely useful to lenders, potential investors, suppliers, and any other entity interested in doing business with a specific company.